Credit card cashback rewards are returns given on the purchase price. To know the amount of the rewards earned in a specific period, you may want to record them. You can record them in QuickBooks by implementing a multitude of methods. Through the List menu in QuickBooks, the quickest method can be applied. Based on different software versions of QuickBooks, the menu or options can be different.

What Does QuickBooks Credit Card Cash Back Reward Mean?

A credit card cashback reward can be defined as an extra-curricular monetary benefit received. These rewards come under rebates and discounts put to the cost price. They should not be taken in the same sense as income. However, they can work as bonuses.

How to Enter Credit Card Cash Back Rewards in QuickBooks?

Using QuickBooks’ List menu, you can enter the cashback rewards earned via your credit card(Add a Credit Card Account to QuickBooks). This method will record the rewards as other income. By implementing another helpful method, you can run the software’s Banking menu. You will find the option to enter the rewards.

Following these two methods given below, you can learn how to enter credit card cashback rewards in QuickBooks.

Method 1: Entering Cashback via List Menu

The basic method for recording the cashback of your credit card in QB requires that you first go to the top menu bar and choose List. Make your way to the Chart of Accounts. Opt for Account and soon pick the Other Income option. The reward for cashback will be entered in QuickBooks.

- First, open “QuickBooks”.

- Now, click on the top menu bar.

- Here, tap on “List”.

- Move to “Chart of Accounts”.

- Now, push the drop-down arrow given beside “Account”.

- Choose “New”.

- Select “Other Account Types”

- Here, opt for “Other Income”.

- Now, press the “Continue” tab.

By carefully following the aforementioned steps, you would have entered the credit card cashback in your QuickBooks account.

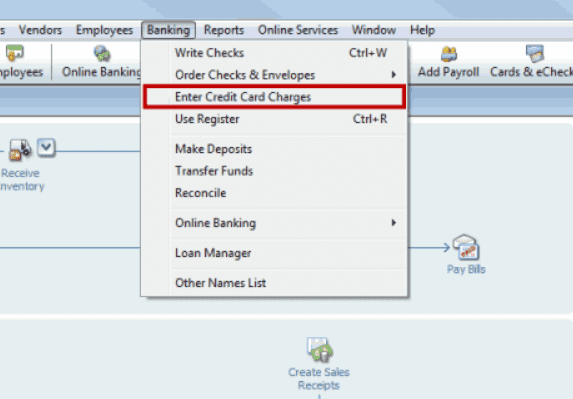

Method 2: Using Banking Menu for Recording Cashback

The QuickBooks software has been given a Banking menu. This menu, when opened, shows Credit Card Charges. This option enables a user to quickly record/enter the cashback rewards earned from his/her card. Eventually, the Save and Close button have to be pressed for storing the recorded information.

- Start the process by opening “QuickBooks”.

- Now, use “Banking”.

- Heading to the “Credit Card Charges” option.

- It will ask you to enter an apt name for it on the purchase field type. Enter it.

- Once you have given a name to it, select your cashback amount.

- Create a charge amount as well.

- Click on the option saying “Save and Close”.

Recording Credit Card Cash Back Rewards in QuickBooks Online

Recording the cashback rewards as the other income in QBO has been extensively preferred by entrepreneurs. Should you also need to do the same, opt for COA after viewing the Accounting menu. Tap on New to see Income. You can Account Type and then record the cashback in QuickBooks Online.

- You can begin by creating your income account.

- Now, go to the left on the menu.

- Tap on “Accounting”.

- Next, click on the “Charts of Accounts” tab.

- Use the “New” button.

- You need to select “Income” from the “Account Type” section.

- Next, choose the “Detail Type”.

- Carefully enter your account name in the given “Name” field.

- Lastly, click on the “Save and Close” option.

Now, let us quickly create a Credit Cash Credit for cashback rewards in QuickBooks Online.

- On the top side of the menu, there exists a “Create Menu”. Press it.

- Choose “Credit Card Credit”.

- After that, choose the payee.

- Fill in the right “Credit Card Account”.

- Now, head towards the section of “Account Details”.

- Enter the “Other Income” or the income account that you have created under the “Account” section.

- Upon checking all the details, enter “Cash Back Amount”.

- Click on the given button for “Save and Close”.

Adding QuickBooks Desktop Credit Card Cash Back Rewards

In order to understand how to enter credit card cash back rewards in QuickBooks Desktop, open it first. After this, go to the Banking section. Visit the Purchase Field and enter your name. Now, after clicking on the Create Account button, your account will be ready. Save the cost amount after putting it in the respective place.

- Launch “QuickBooks Desktop”.

- Open the “Banking” section.

- Put in your name in the “Purchase Fields” option.

- Ensure that your account is created.

- Put the cashback amount in the respective place.

- Save this data.

- Close the software now.

How Do I Record Credit Card Cash Back Rewards in QuickBooks Pro?

For the Pro version of QuickBooks, credit card cash back can be entered by using the Banking section. Then you can move to Purchase and type in your name. An account will be made. In this account, the cashback reward can be added. Lastly, you can save the added information.

- Go to “QuickBooks Pro”.

- Visit the “Banking” section.

- Select “Purchase Fields”.

- Put in your name in “Purchase Fields”.

- Your account will be added. Put the credit card cashback amount in the respective place.

- Save your information.

To Conclude

Going through the blog must have made clear the concept of what QuickBooks credit card cash back rewards mean and how you can enter them. For not only QB but QuickBooks Online, QuickBooks Desktop, and QuickBooks Pro too, we provided you with the methods to record them. We helped you deal clearly with every method to make you understand the various options available.

Learn how to record your PayPal transactions in QuickBooks from the experts. You can also find out the steps to integrate Expensify with QuickBooks.