When bad debts accumulate, your accounts can be affected. At the time of filling any forms such as the ones related to taxes, you may want to know the exact or correct values. Thus, the need for writing off such debts can occur. Other than this, there can be several reasons associated with the process. While you attempt to know them and the process in-depth, you should also see how to write off bad debt in QuickBooks for keeping the accounts up to date. It should be notable that the accounting software gives you several ways to do so, depending on the version owned.

What Does Writing off Bad Debt in QuickBooks Mean?

At times, when sent invoices cannot be collected due to bankruptcy of a customer or other reasons, a company is required to record them in the category of bad debts. Then the company writes them off in QB. When the company writes off bad debt in QuickBooks, the net income and the accounts receivable can stay up to date in its records.

There can be several times when a company might face issues with its debts. These debts can even affect the profit and loss statements of the company. The income statements also see an impact if the debts are not written off. So, the users are required to write off bad debt in QuickBooks Online/Desktop. As a result of this, the invoices get cleared in the records which in turn provide the company with the accurate profits it has created.

How to Write off Bad Debt in QuickBooks?

In the software, there can be two main ways to write off this type of debt. Being aware of the COA option, you can understand the first way. You can also use it in combination with the Receive Payments options for this task. The best way to write off bad debt in QuickBooks Online can include the use of the Report menu, followed by mentioning the associated amount. For doing the same in QBDT, you can check the Lists menu.

Method 1: Through the QuickBooks Chart of Accounts

The Chart of Accounts can carry the details of a company’s accounts. That is why it can help you to write off bad debt in QuickBooks. Initially, you need to choose Company in the menu of QB. Then tap on the Chart of Accounts option. Next, tap on the Account button and move to New. Go for Expense in the drop-down list of Account Type to write it off.

- Go to “QuickBooks”.

- Select “Company” from the menu.

- Tap on the “Chart of Accounts” option.

- Tap on “Account”.

- Choose the “New” option.

- From the “Account Type” drop-down, opt for “Expense”.

- Hit “Continue”.

- Press “Number” and then start typing in the account digits in the provided field, if asked for.

- Next, pick the field of “Account Type”.

- Enter “Bad Debt” in the text box.

- Head to “Ok”.

- This will create the “Bad Debt” account in QuickBooks.

- Now to record it, visit “Customers” on the homepage.

- You need to go for “Receive Payments” from the drop-down options.

- Among the “Customer List” items, opt for your customer whose bad debt you want to write off.

- Tap on the items on the same line corresponding with the bad debt.

- Then you are required to press the “Discounts & Credits” button.

- Pick the “Amount of Discount” tab.

- Fill in the bad debt total.

- After you have completed, move to “Done”.

- Click on “Save and Close” to finish the process.

Write off Bad Debt Via Report in QB

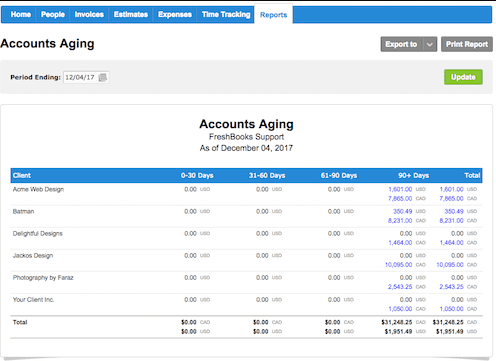

The users of QuickBooks can easily write off the debts if they proceed by the Report tab. For commencing the procedure, visit your QuickBooks account and look for the tab. By pressing the Account Receivable Aging Detail Report, you will be able to check the Outstanding Receivable Account. Now, to grasp how to write off bad in QuickBooks, you can move to its option in Detail Type.

- Run your “QuickBooks” homepage.

- Look for “Report” towards the left.

- Tap on “Accounts Receivable Aging Detail Report” to know “Outstanding Receivable Account”.

- Push the “Gear” tab.

- Then find “Chart of Accounts”.

- Selecting the option for creating a fresh account is needed.

- Press the drop-down of “Account Type”.

- Among the items, choose “Expense”.

- In the “Detail Type” drop-down menu, go for all the bad debts.

- Then mention “Bad Debt” in the “Name” box.

- Tap on “Save and Close”.

- Pick the “Gear” button from the menu.

- Go to “Lists”.

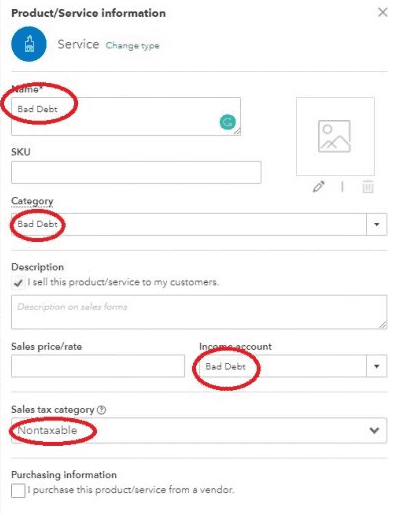

- Choose “Product and Services”.

- Opt for “Non-Inventory” given in the “Information” field.

- State “Bad Debt” in the section for “Name”.

- Also, the user will have to choose the “Bad Debt” option in the section for “Income Account”.

- Remove the mark from the “Taxable” checkbox.

- Move to “Save and Close”.

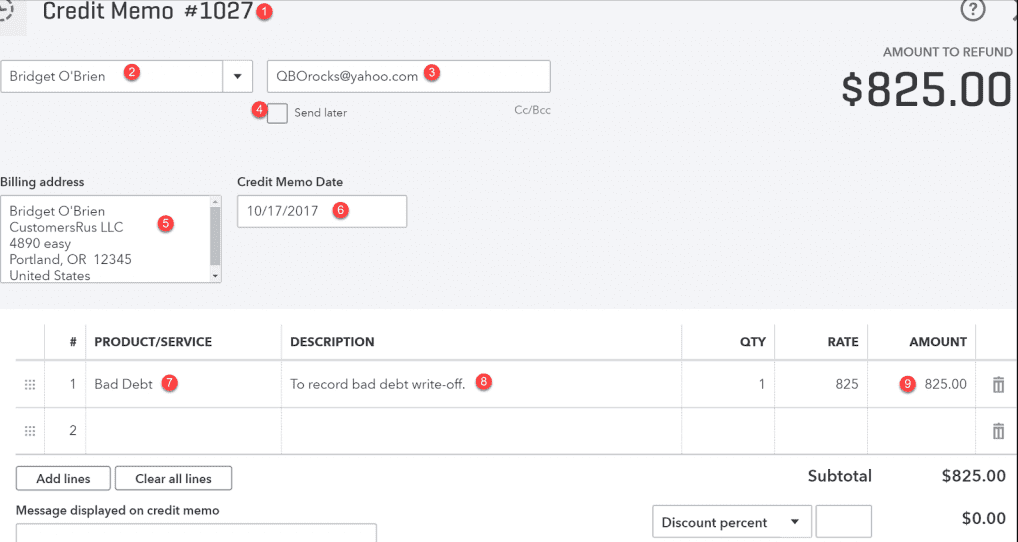

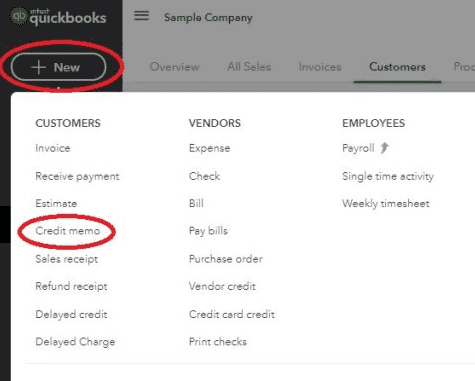

- Tap on the “+” tab.

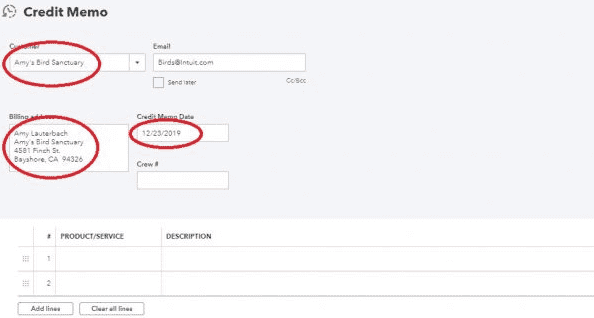

- From the “Customers” area, select “Credit Memo”.

- Then you need to pick your customer via the list available in the given drop-down of “Customer”.

- Choose the items that were formed for the “Bad Debt Product/Service” section.

- On the memo box for text, fill in the amount of the bad debt.

- Hop on to the “Save and Close” button.

- Moving to the “+” symbol will lead you to the “Customers” drop-down.

- Next head to “Receive Payments”.

- Select your customer through the given drop-down list of “Customer”.

- In the “Outstanding Transaction” feature, tap on the invoice which is to be written off.

- You need to tap that credit memo which you had made in “Credits”.

- Ensure that the amount results in “$0”.

- Tap on “Save and Close”.

Method 2: In QuickBooks Desktop Using Lists

In several versions of QB, the Lists menu helps to write off bad debts. QBDT is one of these versions. You will have to open the accounting software and then head to this menu. After that, you can select the Chart of Accounts button. Once done, reach the Account option and choose Expense. Later, you will have to mention 0 as the Payment Amount to write off bad debt in QuickBooks Desktop.

- Visit your “QBDT” account.

- Click on “Lists”.

- Pick the “Chart of Accounts” option.

- Press “Account”.

- Now select “New”.

- Opt for “Expense”.

- Next, go to “Continue”.

- Type in “Account Name” in the required field.

- Hit “Save and Close”.

- Your expense account will be added to keep a track of the bad debt. Please wait for a while.

- For closing out the invoices that are unpaid, select “Customers”.

- Then tap on “Receive Payments”.

- You will have to fill up the customer’s name in the field of “Receive From”.

- In the “Payment Amount” field, type “$0.00”.

- Pick the “Discounts and Credits” option.

- You will have to mention that amount that is to be written off in the field of “Amount of Discount”.

- In the “Discount Account” section, you are required to decide the account that was added in the earlier steps.

- Press “Done”.

- Look for the “Save and Close” tab.

Method 3: Via Report Menu in QuickBooks Online

In QuickBooks Online, to write off bad debt, please pick the Chart of Accounts option. Choose the Report feature from the menu. Then go to the Accounts Receivable Aging Detail Report option. Pick the Outstanding Accounts Receivable and, soon, the debt will have been written off.

- Select the “Report” menu in “QBO”.

- Look for “Accounts Receivable Aging Detail Report”.

- Choose the “Outstanding Accounts Receivable” that is to be written off.

- Click on“Settings”.

- Opt for “Chart of Accounts”.

- Tap on “New”.

- In the drop-down menu of “Account Type”, pick “Expenses”.

- You will find a drop-down named “Detail Type”.

- From here, press “Bad Debts”.

- Type “Bad Debts” in the field of “Name”.

- Press the “Save and Close” button.

- Visit “Settings”.

- Then press on the “Product and Services” tab.

- Now, head to “New” and choose “Non-Inventory”.

- Fill in “Bad Debts” in the “Name” box.

- Pick “Bad Debts” from the available drop-down of “Income Account”.

- Go to “Save and Close”.

- After tapping on the “+New” option, you will have to opt for “Credit Memo”.

- In this step, you are required to choose your customer in the drop-down menu for “Customer”.

- Go ahead to the “Product/Service” area.

- Then find “Bad Debts”.

- Mention that amount that you need to write off in the column for “Amounts”.

- Also, type in “Bad Debt” in the field of “Message Displayed on Statement”.

- Hit the “Save and Close” tab.

- Then go to the “+New” menu.

- Below the “Customer” drop-down, you will find “Receive Payment”.

- Choose your particular customer from the drop-down menu of “Customer”.

- In the section of “Outstanding Transactions”, you need to pick the invoice.

- From the section of “Credits”, look after a credit memo.

- Press “Save and Close”.

- Head to “Settings”.

- Tap “Chart of Accounts”.

- Click on “Run Report” from the “Action Column of the Bad Debts Account”.

Process to Write off an Invoice to Bad Debt in QuickBooks

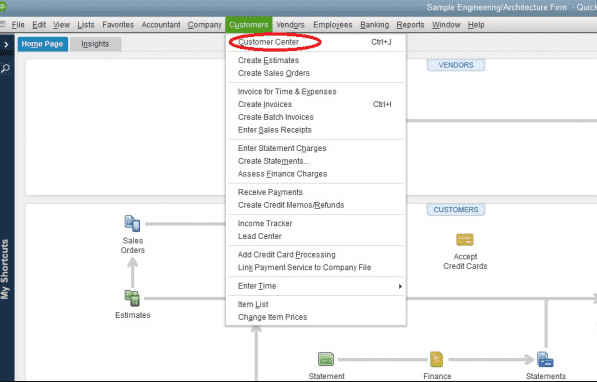

QuickBooks users can write off their invoices to bad debt on their Desktop or the Online version. If you are using the former version, then it is necessary to use the Customer Center menu. Then you will be able to write off the bad debts in QuickBooks Desktop from the invoice. Users of QBO will have to utilize the Sales option present on their window and then go to the Customer button.

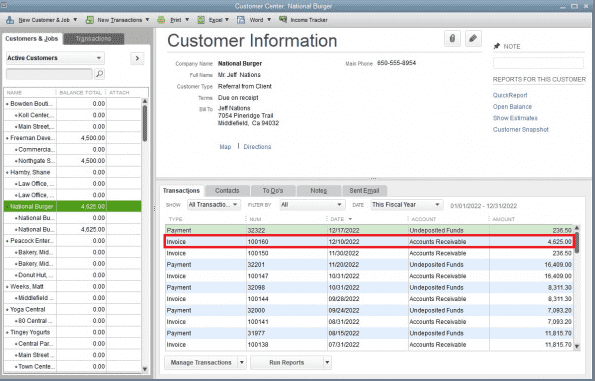

Option 1: In QuickBooks Desktop via Customer Center

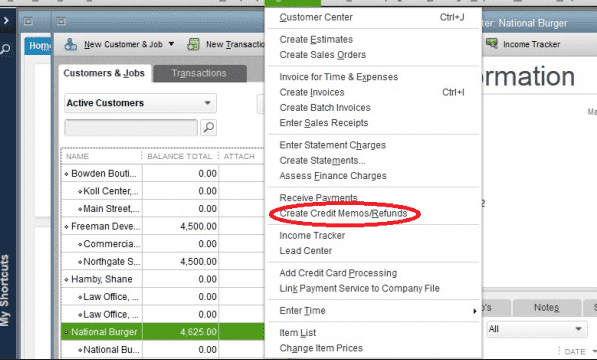

Users of the QuickBooks Desktop software need to avail their Customer Center feature for writing off invoices to bad debts. You are required to initiate the procedure by reaching the Customer Center button in your QBDT account. Then fill in the customer’s name. Tap on the Invoice option to open your invoice. Further, press the Create Credits/Memos Refund button on the Customer drop-down list.

- Move to your QBDT window.

- Click on “Customer Center” from the menu at the top.

- Type the customer’s name.

- For opening the invoice, select the “Invoice” option present in the list.

- Below the “Customers” button, “Create Credit Memos/Refunds” will be situated. Find the same.

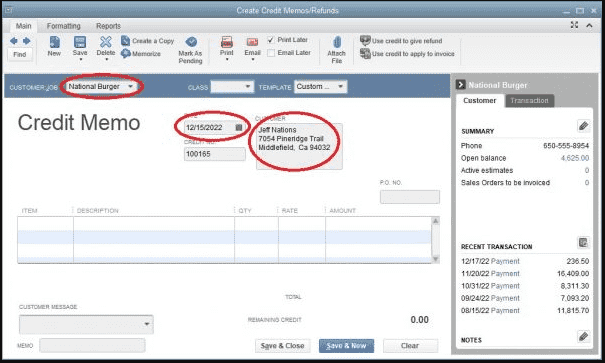

- Mention the name of the Customer.

- Then choose the date on which you want to write off the debt.

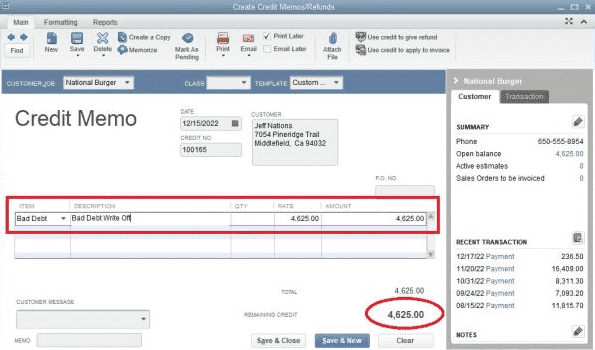

- A number of the credit memo will be created automatically.

Important: Do not change this credit memo number that has been generated. This will create problems during the numbering of credit memos and invoices.

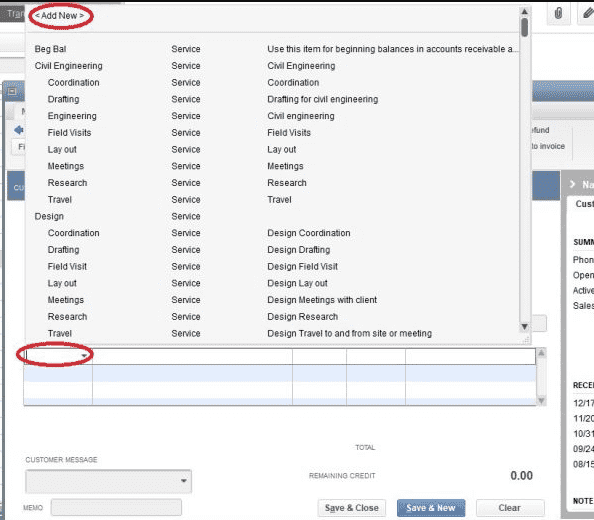

- Select “Item”.

- Press the “Add New” feature.

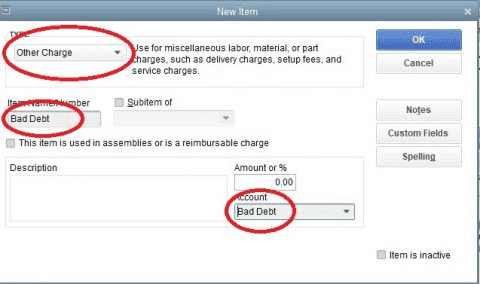

- From the “Type” drop-down, click on “Other Charge”.

- Type “Bad Debt” in the field of “Item Name/Number”.

- Choose “Bad Debt” among the drop-down options of “Account”.

- Press “Ok”.

- Pick “Bad Debt” from the “Item” drop-down.

- Also, verify the items as taxable.

Tip: You may want to check whether you are proceeding in the correct way. Look if the amount of this credit memo and the remaining amount of that invoice that will be written off are equal or not. Should they match, then you are in the accurate direction.

- Once done, the sales tax will have to be applied to this credit memo.

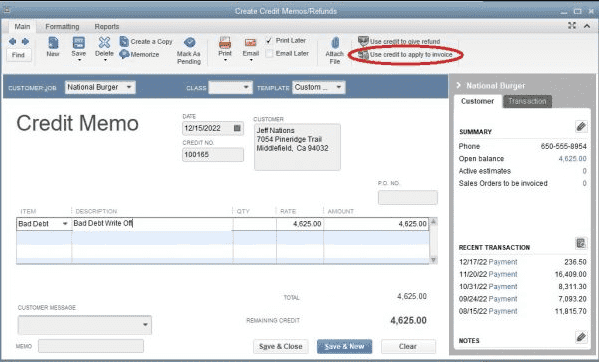

- Tap on “Use the Credit to Apply to Invoice”.

- Then press “Save and New”.

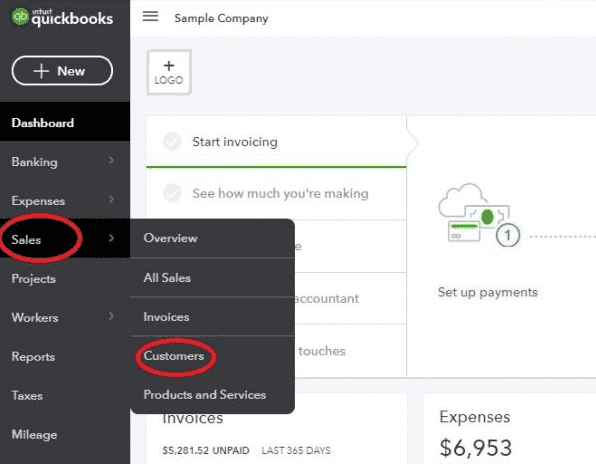

Option 2: Through Sales in QuickBooks Online

The users who are using the online version of QuickBooks are guided to check the Sales menu when bad debts have to be written off. After this, go for the Customers tab. Mention the customer’s name in the provided field. You also need to press on the Customers menu and find the Invoices option for going further to write off invoices to bad debt in QuickBooks Online.

- Launch QBO.

- Select “Sales”.

- Choose the “Customers” option.

- Fill up the name of the customer in the box provided.

- Then tap on the “Invoices” button from the same list of “Customers”.

- This will open up the invoice.

- Right-clicking on the “Browser” button is the next step.

- Tap on “+New”.

- Pick the “Credit Memos” option among the drop-down items.

- Select the name of the customer along with the date on which you will write off.

- Do not change the number of the memo. Let it be as it is.

- Move to “Product/Service”.

- Tap on the “Add New” feature.

- Change the “Product Type” to “Service”.

- In the “Name” field, type “Bad Debt”.

- Also, choose “Bad Debt” among the options in the “Category” as well as in the “Income Account” section.

- Then switch the “Sales Tax Category” to “Nontaxable”.

- Check mark on the items as taxable.

- Also, match the amount of the memo with that of that invoice that is remaining.

- After that, you will have to apply the sales tax on the memo.

- Put a tick against that invoice that is going to be written off.

- Choose a credit memo that is outstanding.

- Make sure to check the payment amount after applying the memo is “$0”.

In Essence

Writing off bad debts can be essential for a company to find its actual income, profit, and loss statements as well as keep its accounts updated. The blog briefly explained the ways to write them off. It is believed that your accounts shall remain as you expect and your other tasks will also be completed.